FBP - Series 1, Post 2: Collaborative Tools and Strategies for Finance Business Partnering

Series I. Strategic Alignment through Finance Business Partnering: 1. Collaborative Tools and Strategies for Finance Business Partnering

Time flies and it’s time for the next post in the Finance Business Partnering series. It’s good that I said the next post will come on 20 October, as public commitments seem to work. I’d like to continue adding ideas, but it’s time to ship. First, a reminder on the structure of the series and then to the post itself.

I. Strategic Alignment through Finance Business Partnering

The Evolving Role of Finance (9 October 2023)

Collaborative Tools and Strategies for Finance Business Partnering (current post)

Trends in Finance Business Partnering (3 November 2023)

II. Collaborative Planning as a Catalyst for Growth

Stakeholder Engagement in Vision and Strategy Alignment

Sustainable Growth through Collaborative Financial Planning

Being Directionally Correct: Navigating Business Constraints

I. Introduction

In the evolving finance landscape, adaptability and collaboration are paramount. A finance business partner can add value only based on understanding and being intertwined with core business functions, therefore we need collaboration tools and strategies to succeed in our work. business partners, finance departments need to pivot from . To add value as a trategic enabler, not just an Excel jockey, I’ll explore today the tools and strategies that foster collaboration from mainly planning perspective.

II. Finance Business Partners: Collaboration in Action

A recent CFO Trends podcast episode Elevating Finance Business Partnerships: Unlocking Their Potential discussed the success factors for being a finance business partner. The episode highlighted how finance professionals can take on the mindset and skills required to be successful business partners, what it takes for a finance organization to go through the transformation, as well as how to measure whether we’re successful in the change.

Initially, the episode described common challenges in taking on a more proactive role. These obstacles include lack of time, unfamiliarity what does finance business partnering mean and difficulties in collaborating with non-finance peers. Barriers can be the systems, processes, capabilities and even organizational culture.

One of the key ideas from the podcast I took on board was the importance of cultivating relationships. It’s both a skill as well as a collaborative strategy that you cannot compensate for when you’ve already reached the time to start the planning cycle. Trust and relationships need to be built over time so that planning cycle can be managed effectively and productively.

Shifting mentalities was another focal point. As a key mindset, finance should transition from being the police to helping people and solving business problems. You will be succesful when business is excited to speak with you. Reflect on this - is your presence perceived as a hindrance, causing conversations to halt? Or is there genuine enthusiasm (or at least neutral acknowledgement) when you offer your perspectives?

An intriguing metric suggested by the was “time spent away from your desk”. Quantifying the success of finance has always been challenging. Should it be measured by stakeholder satisfaction? Return on Equity (ROE)? Time spent away from your desk? It’s an innovative approach at least worth a try.

Ultimately, according to the podcast, finance needs to position oneself from scorekeepers to future advocates and guide business in the journey. I fully subscribe to the idea.

III. The Continued Reign of Excel

For years, Microsoft Excel has been the go-to tool for financial planning and analysis. It's versatile, ubiquitous, and most finance professionals are well-acquainted with its functionalities. Who doesn’t love Excel :) Some key advantages include:

Familiarity: Almost every finance professional has had some exposure to Excel. This makes it easy to adopt and use without a steep learning curve.

Flexibility: Excel can be easily customized to fit your unique style and needs, be it for crafting complex financial models or creating dynamic dashboards.

Collaboration: Microsoft 365 transforms Excel from a solo workspace into a collaborative platform, allowing multiple users to work on the same spreadsheet in real-time, enhancing its collaboration potential.

A survey on 200 US mid-sized company professionals sponsored by DataRails found that:

So, Excel remains as a relevant tool, but even with its formidable capabilities, Excel isn't without flaws. Its scalability can be restricting, version control is often challenging, and there's always the risk of errors that you’ll not see or understand.

The effectiveness of Excel truly lies in the hands of its user. Before transitioning to contemporary tools, mastering Excel is crucial. Merely transferring ineffective habits into newer platforms won't elevate collaboration standards. Excel serves as an ideal learning platform, and its emphasis on clear data analytics and transparency can be integrated into modern tools when the shift is needed.

To illustrate, Excel can be employed to produce beautiful, user-friendly solutions, establishing a sense of trust in your analytical skills and thought processes. This also fosters an environment where continuous improvement is encouraged, as stakeholders can clearly see the path to your conclusions. However, it's worth noting that Excel can be a challenging tool for those outside the finance realm, creating friction, a topic I wrote about recently. The emerging tools aim to offer the clarity, design simplicity, and transparency that can sometimes be challenging to achieve with Excel alone.

IV. The Rise of Modern Planning and Analytics Tools

Business environment is changing at an everfaster pace, and while traditional tools like Excel have served well, the demand for more specialized financial planning and analytics tools has never been greater. Of course, the time to switch to modern tooling seems to always be “now”, but are we getting closer to easier “self-service” implementations? I hope so. The modern era does call for tools that allow us to understand and scenario-plan better the unique challenges businesses face today.

I will below discuss the principles and benefits that resonate with me. I understand that the tooling itself is becoming better and better by the day (and year), therefore a list from 2023 might in any case not be relevant for 2024 and 2025. Furthermore, I do not have first hand experience with most of the modern tools. Onto the principles.

Reimagining Processes, Not Just Replicating: It’s tempting to merely duplicate existing processes into newer systems, but that's not the solution. We both need to accept that it’s not the case as well as make sure that we don’t blindly do that. We need to take the time to think through what in our finance processes are not working before we try to leverage the prowess of modern tools. By doing so, we ensure that our foundational approach is robust, which modern tooling can then enhance.

Transparency and Traceability: One of the standout features of contemporary tools is transparency. With modern analytics tools, every input, change, or decision can be tracked back to its source (with more or less effort). This traceability not only boosts confidence in the insights but also simplifies learning and iterations to reach to a relevant outcome.

Version Control: Hopefully, gone are the days of sifting through multiple file versions, trying to decipher the most recent or accurate. Modern tools come with integrated version control, ensuring that everyone is on the same page, literally and figuratively. One needs to know how to use these features.

Enhanced Collaboration: The new age tools emphasize real-time collaboration. No longer should an analyst need to send out 40 separate Excel sheets and then grapple with the daunting task of merging responses. With modern platforms, multiple stakeholders can simultaneously contribute, edit, and review – all within a unified environment.

Design and Ease of Use: As before, a tool's design isn't just about aesthetics; it's about trust. An intuitive, user-friendly interface ensures not just ease of use but also fosters confidence in the outcomes and insights. A beautifully designed tool minimizes friction and promotes active engagement.

Reduced Reliance on Cumbersome Practices: Mailing bulk Excel files, manual consolidations, and repetitive data entries are practices of the past (and the present…). The new tools help you automate these tedious tasks, freeing up time for more strategic activities.

When we don’t need to spend 80% of our time massaging the data and inputs, we can take a step back and think through are we doing the right things. It is a tough reality when modern tooling reveals that what you wanted to automate actually was mostly irrelevant. But we need to learn this sooner than later to provide the value that we want to provide.

In conclusion, the modern suite of financial planning and analytics tools is not just an upgrade in technology; it's a shift in philosophy and mindset. We should keep in mind what we want to get from the tooling - data-driven decisions that are made swiftly and confidently.

V. The Fifth Discipline: Building a Learning Finance Ecosystem

Peter Senge's "The Fifth Discipline" is one of the books that based on the cover I didn’t pick up very fast, but which included content that really resonated with me. In connection with Finance Business Partnering, I believe the book provides a blueprint that's relevant for creating a collaborative financial ecosystem.

Here's how his principles align and augment the FBP landscape:

Systems Thinking: More than just a theoretical approach, systems thinking is the lens through which finance professionals should view their domain. It is about perceiving the organization as a cohesive whole rather than fragmented units. For finance, this means not just seeing numbers, but understanding their narrative (think also storytelling). Every financial decision, big or small, flows through the organization. What you recommend and shed light on influences what customer facing roles, sales, marketing, operations, and others do. By embracing systems thinking, finance experts can predict and understand these ripples and their impacts, ensuring that they pave the way for more informed decisions.

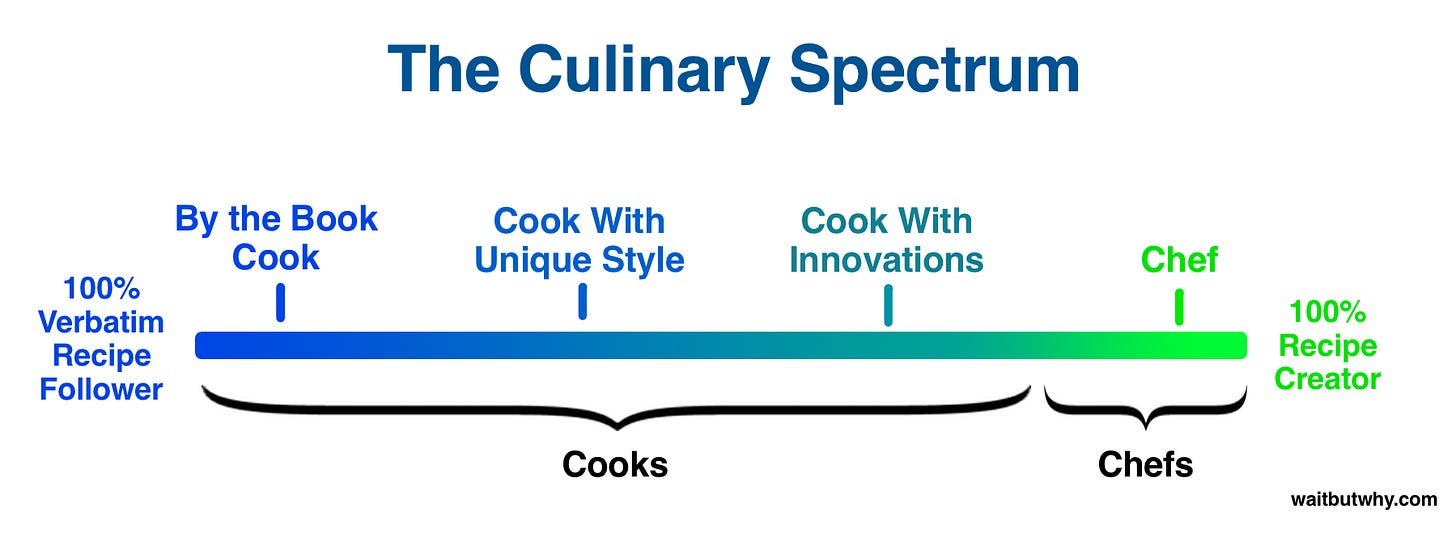

Personal Mastery: Finance roles are continuously evolving, including the current theme of finance business partnering. Finance professionals need to evolve with the times and business expectation. Personal mastery isn't just about technical proficiency but also curiosity, thirst for learning (including testing whether you are right, not proving you are right), developing, adaptability, and the desire to continuously refine one's skills. It's this mastery that differentiates a regular contributor that will be automated away from someone who drives change. As Tim Urban aptly put it, aim to "be the chef, not the line cook." A chef innovates and sets the direction, while the line cook, albeit essential, follows set recipes. When something doesn’t go as expected, the chef knows what happened, the line cook tries again without learning or google’s for a new recipe.

Shared Vision: Finance is the backbone of an organization, and its strategies should be in sync with the company's broader objectives. But it's not just about alignment; it's about inspiration. A shared vision ensures that every department, from marketing to product development, is marching to the same rhythm. Finance has a critical role in sharing the vision throughout the planning cycle. When finance professionals foster this collective vision, they act as the bridge, ensuring that every decision, every strategy, and every goal echoes the organization’s core mission and values.

Bring another idea into this section, according to Roger Martin, integrative thinking is as well about embracing complexity and finding solutions that incorporate diverse perspectives. In finance, this means not getting tethered to binary choices (profitability vs growth), but exploring the entire spectrum of possibilities with an open mind.

VI. Peopleware: The Human Side of Collaboration

Financial business partnering, tool usage and transformation all include parts of product and project thinking. One of the books I appreciate on a more software development oriented theme is “Peopleware” by Tom DeMarco. The book emphasizes the importance of the human factor. These insights, while originally tailored for software projects, can in my mind applied to the realm of financial business partnering, emphasizing that beyond models and spreadsheets, there's a human element driving success.

Peopleware Principles in Financial Business Partnering

Human-Centric Tools: Any tool is only as effective as its user. Based on the themes of of “Peopleware”, tools for financial business partnering should cater to the user's human needs, making them more about facilitating conversations and enhancing mutual understanding than just about crunching numbers and finding what is precise and correct.

Team Dynamics & Jelled Teams: “Peopleware” speaks about the concept of “jelled” teams - those that gel together and function cohesively. In finance, this means creating a collaborative environment where mutual respect and open dialogue reign supreme. Both for finance and finance as part of the whole organization. It's about team chemistry, where the sum is greater than its individual parts.

Workspace and Environment: As highlighted in "Peopleware", the workspace plays a critical role in team productivity and harmony. For finance teams, this could mean providing spaces that encourage spontaneous discussions, ensuring a balance of focused work zones and collaborative areas, and incorporating flexibility in the work environment. Collaboration in today’s cross-country and hybrid work environment mean focusing on collaboration tools and their usage as well as ensuring the time to create a human connection outside the direct tasks.

Protection from Interruptions: Just as software developers need uninterrupted flow time, finance professionals need periods of deep focus, especially when dealing with modeling or analysis. Recognizing and minimizing needless interruptions can drastically improve productivity. The concepts of deep work and flow belong here as well.

Beyond Peopleware: Enhancing Collaboration and Communication

Active Listening and Empathy: Communication is the bedrock of collaboration. Active listening—approaching discussions without preconceived judgments and ensuring that every voice is heard and valued—is vital. It might be tempting to go all in with your newfound insights or precise forecasting, but this will not make your life any easier. Listen and learn.

Harnessing AI for Communication: In the era of digital transformation, AI tools can act as a bridge for those professionals who might not be natural communicators. Let’s face it, FP&A professionals are not the most extroverted people around. AI tools can help us out in trying out how our communication may be perceived, what might your stakeholders really expect from you. Take the time to generate the 5 ice breaking questions to have a more smooth conversation when you are stuck with your business counterparties without the financial model in front of you.

Integrating insights from "Peopleware" with modern practices in financial planning underscores the significance of the human element as well as provides the basis to think how to build the foundation for effective collaboration.

VII. Conclusion

The dynamic business landscape requires adaptability and collaboration from finance. Finance professionals, in the evolution to finance business partners should know how to utilize both time-tested tools like Excel as well as modern analytical tools to foster effective planning and analysis.

While technological advancements are here to make the work smoother, human element remains central. The principles from “Peopleware” and “The Fifth Discipline” bring out the need for having a systematic view how tools, processes, and the human element create an environment where through trust and shared vision we can do the right things, not just things right.

Finance's transformation into business partnership roles requires balancing the onboarding of new tools and nurturing genuine human interactions. Financial business partners are not just tasked with number-crunching; they're the agents of change who bridge the gap between data-driven insights and strategic business objectives. Sounds good, doesn’t it?

Whether it's through mastering Excel or integrating modern planning tools, the end goal remains consistent: collaborate so that decision-making is both swift and confident, all while fostering mutually beneficial relationships geared to reaching shared objectives.

Key Takeaways:

Collaboration and adaptability drive financial success.

Finance role evolution emphasizes business partnerships.

Trust is foundational for effective planning cycles, build trust before the planning cycle starts.

Excel remains relevant, but modern tools offer advantages.

Financial tools should enhance decision-making processes.

“The Fifth Discipline” provides a blueprint for having a foundation to offer value as finance business partners.

Human-centric tools foster effective communication.

Embrace both technology and the human element.

Active listening is vital for genuine collaboration.

Thanks for reading until the very end! Next article in two weeks.

I. Strategic Alignment through Finance Business Partnering

The Evolving Role of Finance (9 October 2023)

Collaborative Tools and Strategies for Finance Business Partnering (current post)

Trends in Finance Business Partnering (3 November 2023)

II. Collaborative Planning as a Catalyst for Growth

Stakeholder Engagement in Vision and Strategy Alignment

Sustainable Growth through Collaborative Financial Planning

Being Directionally Correct: Navigating Business Constraints

Comprehensive guide on finance business partnering - especially appreciate the emphasis on systems thinking and collaborative tools for strategic alignment. The shift from scorekeeping to future advocacy is crucial for operational finance. TCLM explores similar themes in trade credit and working capital management, offering practical frameworks for financial leaders.

(It’s free)- https://tradecredit.substack.com/